When we invest in – and co-build – B2B subscription businesses, we take pride in our shared dev-ops stack and operator DNA. But the real scoreboard isn’t our codebase; it’s the trio of metrics that tell us whether a product is compounding or coasting: Annual Recurring Revenue (ARR), Customer Lifetime Value (LTV) and Churn. Below is how we look at each number, why they matter, and where they’re already moving inside our current portfolio (TaskPlatform, MyPressWire, Sloif and SignIT).

1. ARR: the altitude dial on your SaaS rocket

What it is. ARR is simply the sum of all recurring subscription revenue expected over the next 12 months, adjusted for upgrades, downgrades and lost customers. In formula form:

ARR = (MRR start + new MRR – churned MRR ± plan changes) × 12

Why we care. Growing ARR shows the market is voting “yes” with real money. It also powers our financing model: once a company passes €10k-€50k in MRR with healthy retention, we can layer on banking facilities without forcing founders to over-dilute. That’s exactly how TaskPlatform used a €300k credit line to triple ARR in nine months – all while the founders kept 52 % ownership.

Operator tip. Track ARR as a bridge (new, expansion, contraction, churn). It turns a flat number into a story you can act on every month.

2. LTV: the long-lens we use to price growth capital

What it is. LTV estimates the gross profit a single customer will deliver over their lifetime:

LTV = ARPA × gross margin × customer lifespan

In practice we tweak the formula to include expansion revenue and a discount rate, but the principle is the same: how much is a relationship worth if we keep serving it well?

Why we care. When we invest operational resources – think shared onboarding modules, billing, analytics – we want to see every euro of CAC return at least 3-4 euros of LTV within 12 months. After we plugged our authentication and usage-metering modules into Sloif, average LTV jumped 28 % because the team could upsell AI-powered add-ons without rebuilding the paywall.

Operator tip. Re-calculate LTV after every material pricing or packaging change; otherwise the payback math you present to investors is stale the day you ship the new plan.

3. Churn: the silent killer (and sometimes secret weapon)

What it is. Churn is the percentage of customers – or revenue – you lose over a period. The basic customer churn formula is:

Churn % = (customers lost ÷ customers start) × 100

We run both logo churn (accounts lost) and net revenue churn (after expansion revenue) because together they surface two different truths: product fit and account growth.

Why we care. A 5 % monthly logo churn means you must replace over half your user base every year – that’s cash you could be spending on product instead. Conversely, negative net churn (expansions outpace losses) is SaaS magic: it lets us model far higher LTV without touching CAC. MyPressWire hit –3 % net churn last quarter after releasing its self-serve newsroom templates – proof that solving one pain point deeply can expand ARPA faster than new-logo sales ever could.

Operator tip. Segment churn. Sign-up-heavy SMB cohorts almost always behave differently from enterprise lighthouse accounts.

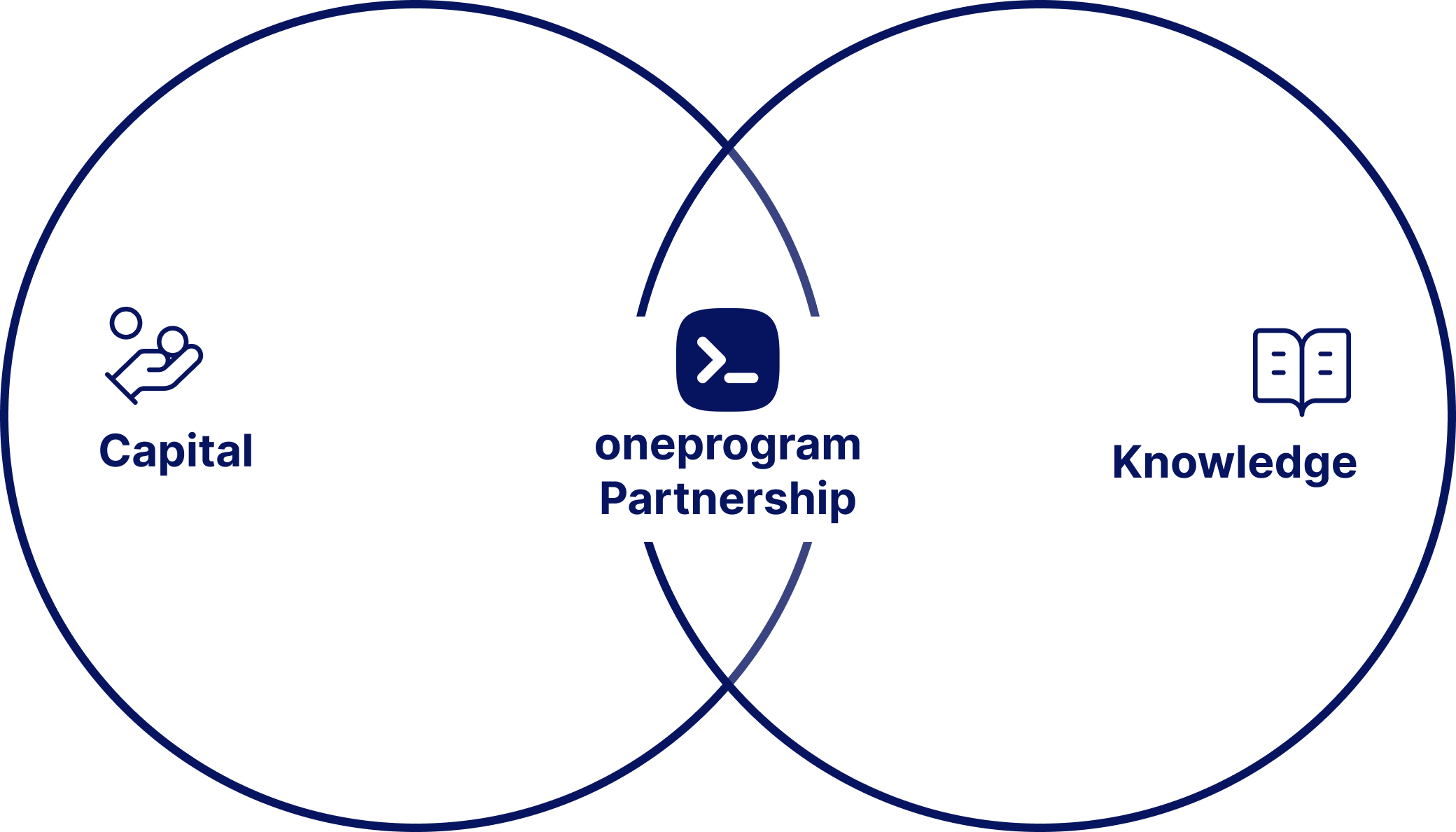

4. How the trio works together in the OneProgram model

- Screening. We only engage with companies already in the €10k-€50k MRR band and ≤10 % annual logo churn – a guardrail that keeps our hit-rate high.

- Shared infrastructure. By dropping in common modules for auth, billing and analytics, we improve gross margin (feeding LTV) and tighten onboarding (reducing churn).

- Capital allocation. Once ARR growth and net retention stabilize, we unlock non-dilutive debt so founders keep 50-70 % at exit – the core of our thesis.

- Board rhythm. Every board pack opens with an ARR bridge, rolling LTV/CAC and segmented churn. If the three charts don’t tell a coherent story, we stop the meeting and dig until they do.

5. Due-diligence quick list (for founders & co-investors)

Before we sign a term sheet we always:

-

Pull the raw MRR ledger and rebuild the ARR bridge ourselves.

-

Ask for LTV cohorts by acquisition quarter – projected values alone don’t cut it.

-

Reconcile churn definitions (customer vs revenue, gross vs net). A 3 % number is meaningless until you know which one.

-

Cross-check growth claims against CAC payback and Magic Number benchmarks.

Final word

At OneProgram we’re builders first, investors second. When we talk about ARR, LTV and churn, it isn’t consulting jargon – it’s the way we decide which features to ship next, how much to spend on paid acquisition, and when to pour fuel on the fire. If you’re a founder sitting on solid early ARR and you think these numbers can sing louder with the right partner, let’s start a conversation.

Because spreadsheets don’t scale companies – but the truths hiding in them absolutely do.