Investors

Powering the Next Generation of B2B SaaS—Together

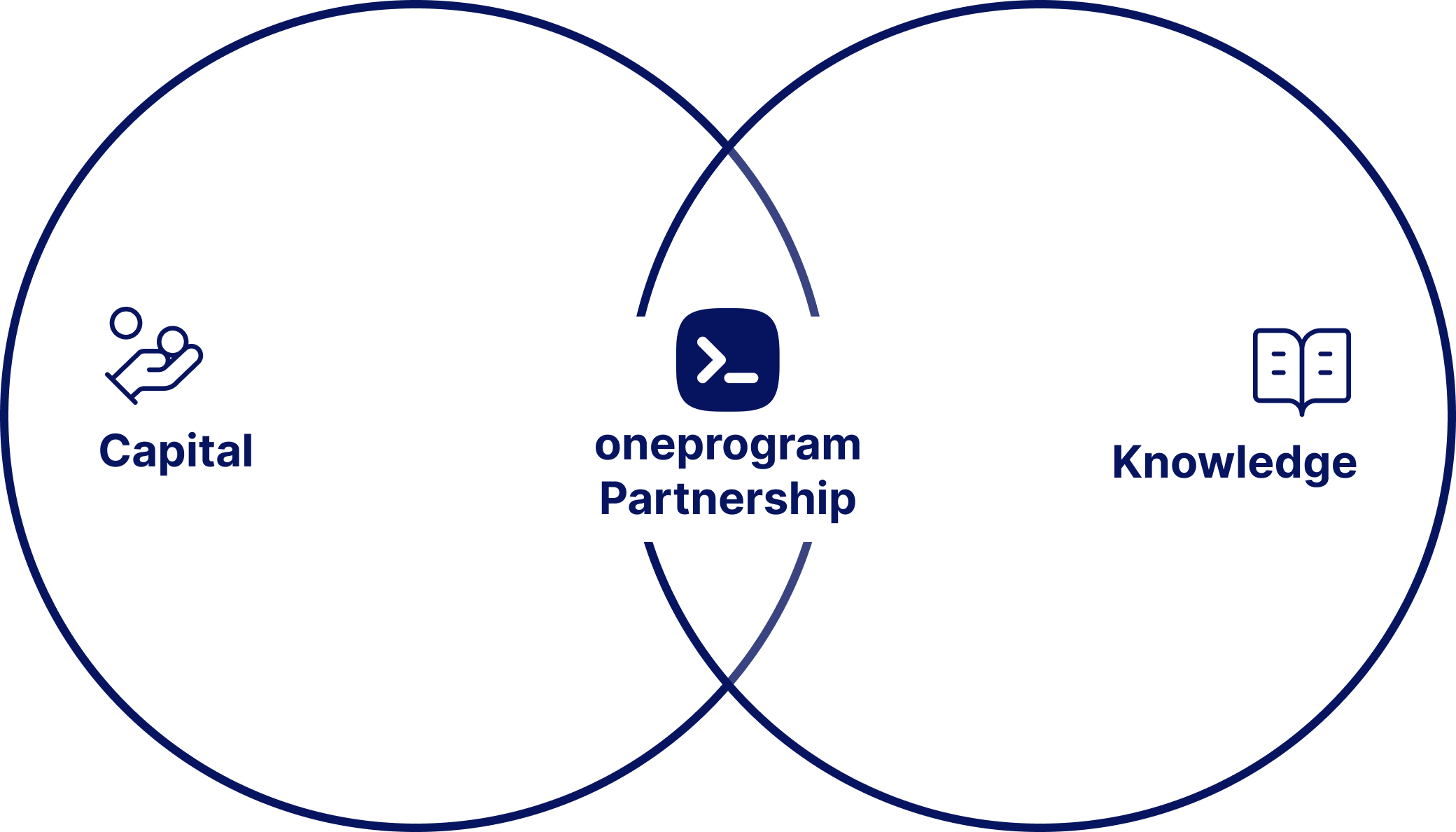

OneProgram partners with ambitious founders to build, scale, and exit B2B subscription businesses. By investing capital and deep operational know‑how, we accelerate ARR growth while preserving founder ownership. Now we’re opening our model to a select group of knowledge investors who share both our passion and pedigree.

Why partner with OneProgram

Single‑minded focus

100 % B2B SaaS, recurring‑revenue models only

Hands‑on operator DNA

Team of experienced SaaS professionals & executives with multiple SaaS exits

Capital‑efficient platform

Shared dev‑ops, GTM playbooks, and modular codebase shorten time‑to‑market

Proven traction

4 portfolio companies live (TaskPlatform, MyPressWire, Sloif, SignIT) & founder team previously sold MarketingPlatform

Alignment with founders

We co‑build and co‑own – no “spray and pray”

Our Investment Thesis

01

Early Scale Entry

€10 k–€50 k MRR companies with proven product fit and proven business model

02

Vertical Breadth, Horizontal Stack

Solve mission‑critical ops (key part of customers toolbox)

03

Shared Infrastructure

Common modules for auth, billing, and analytics cut burn by up to 50 %

04

Sustainable Growth > Blitzscale

Revenue quality first; debt and dilution last

Founders keep ~50‑70 % ownership at exit through the OneProgram Model

The Investor Fit We’re Seeking

- Business angels & venture funds with hands‑on SaaS B2B experience

- Successful exit behind you – acquisition or IPO

- Ability and appetite to mentor founders monthly and open GTM networks

- Ticket size €100 k – €1 M (individual) or €1 M – €3 M (fund)

If you believe smart capital comes with sleeves rolled up, we want to talk.

Portfolio Snapshot (October 2025)

| Company | Segment | Ownership |

| TaskPlatform | Orderhandling and service | 52% |

| MyPressWire | PR & MarTech | 80% |

| Sloif | CRM AI tools & MarTech | 32% |

| SignIT | e-Signature | 17,2% |

| Gandium | Marketing automation | 40% |

| Auto business | Software for the industry | 40% |

| Insurance | Software for new area | 30% |

Let’s Build Multipliers

📧 invest@oneprogram.com

📞 +45 42 555 555

📍 Rølkjær 4, DK‑6600 Vejen

Ready to amplify the success of

your SaaS investments?

Focused Expertise: We have a clear investment thesis centered exclusively around B2B SaaS companies, giving us unmatched depth and precision in guiding your journey.

Real Partnership: Our commitment goes beyond capital. We actively invest our knowledge, resources, and network to maximize your company’s growth trajectory.

Founder-First Approach: Founders are at the center of our investment strategy — we invest in people first. By building strong relationships founded on trust, transparency, and authentic collaboration, we ensure alignment with your vision and entrepreneurial goals.